The Inflation Reduction Act (IRA) of 2022 includes close to $400 billion for energy and climate projects directed at reducing carbon emissions 40% by 2030.

Breaking it down, the broad-ranging IRA has appropriated:

- 8 billion to the U.S. Department of Energy (DOE) for competitive grant projects through 2026 for industrial facilities to install, retrofit or upgrade technology to reduce greenhouse gases

- $2.15 billion to install low-carbon materials in General Services Administration-owned buildings

- $330 million to the DOE to help state and local governments adopt residential and commercial building energy codes.

- $250 million to develop and standardize Environmental Product Declarations (EPDs) for construction materials, with grants and technical assistance for manufacturers

- $100 million to identify and label low-carbon materials and products for federally funded transportation and building projects

Offering some perspective on the significance of this large allocation of funds and EPDs, the Green Building Initiative (GBI) states, “the work of developing EPDs and identifying and spurring the creation and manufacture of low-carbon buildings and construction materials is going to be a significant and impactful effort by the federal government, using the federal government’s purchasing power in the marketplace to drive private sector change.”

GBI also notes that the DOE and GSA’s recent provision of funding is in addition to funds already allocated in the federal government’s massive 2021 infrastructure bill.

What Architects and Owners Need to Know

It’s important to note that tax reductions for energy efficient investments have been available to designers and building owners for some time under the Tax Deduction for Energy Efficient Buildings (179D). What has changed is the level of reduction and easing of qualifying parameters, thereby making these credits much easier to access.

In the previous federal energy efficiency program, tax credits could be achieved for products and systems enabling the building to be 50% more energy efficient than a comparable building. The tax reduction cap was $1.88 per square foot and owners could only apply once over the life of a building.

Now under the new Act, the threshold has been significantly lowered and the incentives have increased.

- The building only needs to be 25% more energy efficient than a comparable building.

- Owners can cash in on a reduction of up to $5 per square foot.

- Owners can apply for the tax credit every three years.

A project’s deduction value is directly related to increasing levels of building energy efficiency. Operating on a sliding scale, the minimum efficiency gain of 25% over baseline will yield a 50 cent per square-foot deduction, scaling up to a $1 per square-foot deduction for a 50% efficiency gain. The larger $5 per square foot reduction can be earned if prevailing wage and apprenticeship requirements are met.

Also of note, in Section 48 of the IRA’s Energy Investment Tax Credit, electrochromic glass is now recognized as an “energy property” which means the tax credit applies to electrochromic glass as well.

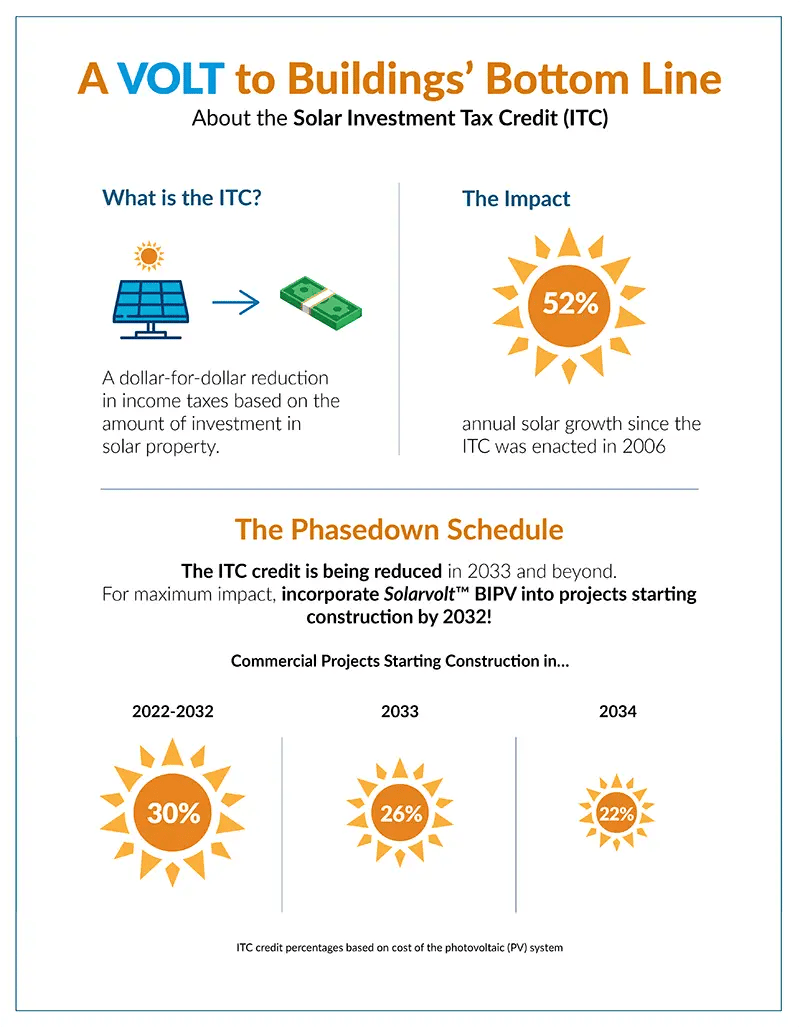

Solar Investment Tax Credit

As part of the IRA’s focus on renewable energy, the previous Solar Investment Tax Credit (ITC) has been expanded to offer a 30% tax credit for the installation of photovoltaic systems between 2022 and 2032. In 2033, this reduction will decrease to 26%, and in 2034, the credit will be 22%.

The credit applies to investing in building integrated photovoltaic (BIPV) glass systems electrical components and energy storage devices with a capacity rating of 3 kilowatt hours or greater.

The legislation also includes a 40% investment tax credit for solar and wind projects in low-income areas.

Glass’ Contribution

Since high-performance glass significantly reduces lighting and HVAC consumption, glazing is an important carbon emissions reduction strategy and essential for passive house buildings, which require an extremely tight enclosure supported by double- and triple-glazed openings.

“All Phius projects are eligible for the rebates and incentives included in the IRA, so we expect to see a continued rise in projects as owners look to take advantage of the legislation,” says Katrin Klingenberg, co-founder and executive director of the Phius Passive House Institute US.

Demonstrating high-performance glass products’ potential impact on climate initiatives, a recent Glass for Europe study reported that replacing all existing windows with “readily available high-performance glazing” by 2030 would cut annual energy use by 29% and annual carbon emissions by 28%. And replacing all existing windows with “improved high-performance glazing” by 2050 would cut both annual energy use and carbon emissions by 37%.

Transferring this data to the U.S., Stephen Selkowitz, principal of Stephen Selkowitz Consultants and an affiliate with the Lawrence Berkeley National Laboratory, estimates that retrofitting all U.S. commercial windows with next-generation glass technologies would transform a net drain of $20 billion in energy costs to a net gain of up to $15 billion in energy savings.

Taking an important step in this direction, the IRA will drive energy efficiencies and carbon reduction, and make the return on investment for high-performance products like glass much more attractive.

For information on Vitro Architectural Glass products that can help a building project qualify for IRA tax reductions, please visit www.vitroglazings.com/products.

Updated on April 11, 2023